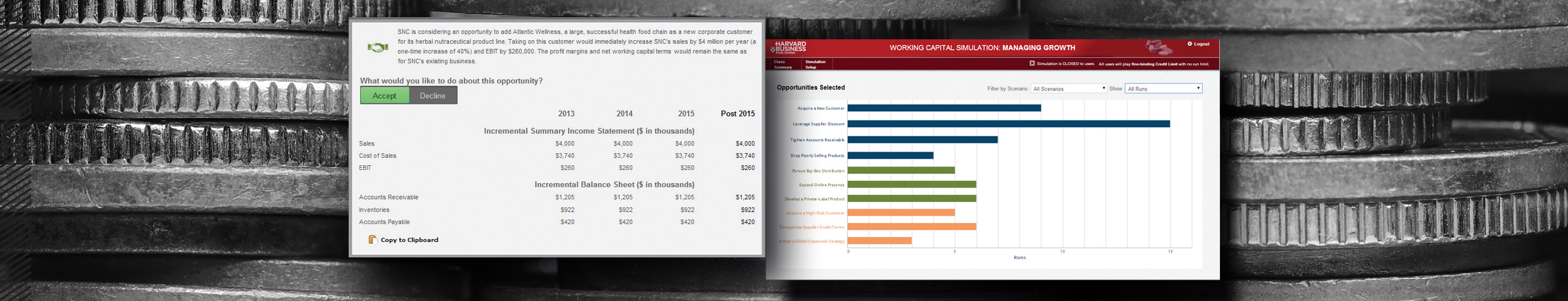

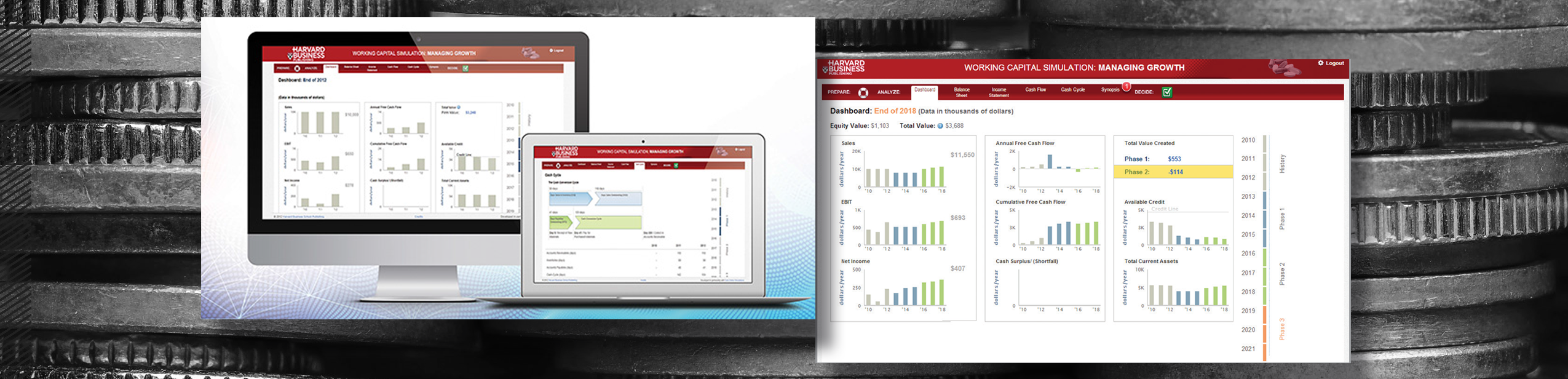

The participants play the role of CEO for Sunflower Nutraceuticals, a distributor and retailer of dietary supplements. Working in three rounds spanning ten simulated years, learners choose to invest in growth and cash-flow improvement opportunities such as taking on new customers, capitalizing on supplier discounts, and reducing inventory. Each opportunity has a different financial profile and the participants must analyze the short- and long-term impacts on their working capital. Participants recognize the interconnection between income statement, balance sheet, and statement of cash flows. Illustrating that not all growth is value-creating, they deepen their understanding of the important distinction between profitability and liquidity, and why “recording profit” is not equivalent to collecting cash. Participants learn to maximize a firm’s growth opportunities in a limited-credit environment.

Participants recognize the interconnection between income statement, balance sheet, and statement of cash flows. Illustrating that not all growth is value-creating, they deepen their understanding of the important distinction between profitability and liquidity, and why “recording profit” is not equivalent to collecting cash.

They learn how to balance growth opportunities and liquidity constraints. Growth is important, but these key questions must be considered:

Participants also develop a cross-functional perspective. They learn that line managers heavily influence a company’s operating ratios in many ways. Decisions at a company are interrelated, and sound working capital management extends beyond the finance and accounting functions, notably to logistics, sales, operations management, and marketing. Sales managers must ensure that certain sales reps aren’t selling primarily to customers who are poor credit risks and that the number of receivable days is kept at an acceptable level. Operations managers, responsible for inventory, must ensure that the days sales in inventory (DSI) figure doesn’t become too high, thereby requiring excessive working capital.

Finally, Participants learn to maximize a firm’s growth opportunities in a limited-credit environment. For Example, a high-margin business can reduce the need for external funding by collecting receivables earlier, even if that means offering discounts to induce earlier payments. A low-margin business will gain more by increasing its profitability and optimizing its working capital than by simply increasing sales.